Your Small Business Funding Resource

business Funding has never been easier

Funding for All Business Types

Fast and Simple

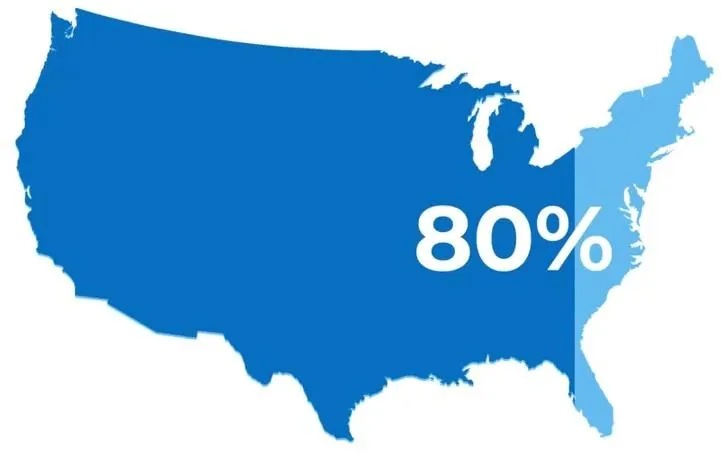

Banks are Great for 20% of Small Business Owners

What about the other 80%?

Bank Breezy Has You Covered!

The Bank Breezy Platform

✓ FinTech platform launched in 2016 to offer small business owners a source for working capital

✓ Backed by 50+ lending partners that compete for the opportunity to fund small businesses

✓ Over $20 Billion in Small Business Funding in the

last 5 years

✓ 650,000+ Small Business Funding Applications

Bank Breezy Is Your Go-To Solution!

Bank Breezy has the SOLUTION for 80% of American Small Businesses

According to the US Bureau of Labor Statistics (BLS), approximately:

20% of new businesses fail during the first two years

45% during the first five years

#1 Reason for Failure:

Lack of Working Capital

7 out of 10 businesses need working capital in the next 90 days

4 out of those 7 need working capital today

Bank Breezy Has Your Back!

100% Online App Sequence

Step 1

Apply

Step 2

Link Bank or

Upload Statements

Depending on funding type and amount, you will be approved simply by verifying and linking your bank account or uploading your bank statements

Step 3

Receive Offer and Get Funded

With most fundings, you will receive an instant offer. With larger fundings and Lines of Credit, you will receive an offer via email within one hour to one business day

Types of Funding Opportunities

Gig Worker Funding

Instant Approval & Funding

Amounts from $500 to $5,000

with No Credit Check

5 Minute Online Application Process

Link Bank Account with Secure PlaidTM Linking

Accept Offer

Funded in 8min or less

Business Funding

Funds based on Your Revenue, not your Credit Score

Fast Online Funding up to $2,000,000

Minimum Requirements:

Business Checking Account

Online Banking Setup

4+ Months in Business

$15,000+ Monthly Sales

Owner has 500+ FICO Score

Minimal NSFs/Negative Days

Current Loan Consideration

Business Line of Credit

up to $100,000

1. Apply Online

5 Minute Process with Soft Credit Pull

2. Receive Offer

Best offer Within 1 Business Day

3. Accept Offer

No Obligation to Proceed

4. Receive Funds

Fuel Your Business

Asset-Based Lending

Equipment Financing based on your Revenues

Collateral based

Must have credit of 660+

Contact us for further details

Merchant Payment Processing

Eliminate up to 95% of your processing fees

Contact us for further details

Frequently Asked Questions

What is the Lowest Rate Guarantee Meet or Beat Program?

Bank Breezy is going above and beyond to insure their customers get a one stop, best offer guarantee. With the Meet or Beat Program, they not only match competitive offers, but promise to beat them. If Bank Breezy can't offer you a better rate, they will pay YOU $500 for your trouble.

Must meet the following qualifications:

-Must have $20k+ in monthly revenue each of the last three months

-Must have been in business for at least 12 months

-Must be a 1st or 2nd position only

-Must provide us with any offer they receive from a competitor showing the detailed offer, funder name, and have not signed any funding contract with another funder supplying offer.

-Excludes high-risk businesses, such as, but not limited to; Transportation, Real Estate and Adult Industry businesses.

-No previous funding defaults or derogatory payment history.

-Offer expires 10 days after the offer has been presented to the client.

-Best offer guarantee refers to "Cost of Capital" and repayment amount only.

-Offer is subject to change without notice.

-Funding is subject to credit approval, background checks, and final bank verification process being completed and accepted.

-Certain restrictions apply.

-Not valid in: California, Nevada, New York, Utah, Virginia, North Dakota, South Dakota, and Montana. Or any other states where best offer guarantees are not permitted.

What is Breezy Connect Cash?

Breezy Connect Cash is an outstanding program that was designed to help business owners pay off their fundings faster. Share the Bank Breezy funding opportunity with your network of relationships and earn 2% of all fundings.

Business owners who participate will receive funds deposited into their bank accounts-along with directions on how they can use those funds to pay down their balance, IF THEY CHOOSE. With this program they can even earn more than you owe!

What is the Gig Economy?

A gig economy is a labor market that relies heavily on temporary and part-time positions filled by independent contractors and freelancers rather than full-time permanent employees. Gig workers gain flexibility and independence but little or no job security.

32% of U.S. labor force is made up of Gig workers or 1099s. That's over 60 Million people driving, dog walking, freelancing, consulting, babysitting, and delivering anything imaginable.

Gig Economy Challenges

>Gig workers and 1099 workers lack access to capital

>Gig workers and 1099 workers face unexpected expenses, irregular cash-flow, platform changes, regulations, licensing and insurance

>Fragmentation of income and banking

>Underwriting gig economy income

>Gig workers historically trend sub-prime

>Government subsidies, stimulus and unemployment benefits

Who is PlaidTM Linking?

Plaid is one of the most trusted digital finance platform that connects thousands of companies to millions of customers for faster, safer, and more seamless financial experiences. If you use Venmo, Acorns, SoFi, Chime, Flexport, Betterment or Uphold, you already also use Plaid.

What is a Soft Credit Check?

A soft credit check, also known as a soft inquiry or soft credit pull, is a request for a person's credit report and credit score that doesn't affect their credit score. Soft credit checks are different from hard credit checks, which are used by lenders to decide if they want to extend credit and can impact a person's credit score. Soft credit checks are only visible to the individual and not to lenders.

What are the Bank Breezy Repayment Terms?

Repayment terms are either daily or weekly. Monthly repayment terms are not available. There are no pre-payment penalties with Bank Breezy, on the contrary, if you pay the funds back earlier than the originally agreed upon terms, your rate will be reduced significantly, thus giving you a huge discount.

What is the V Bottom Business Solutions relationship with Bank Breezy

V Bottom Business Solutions is the Regional Funding Director for Bank Breezy.